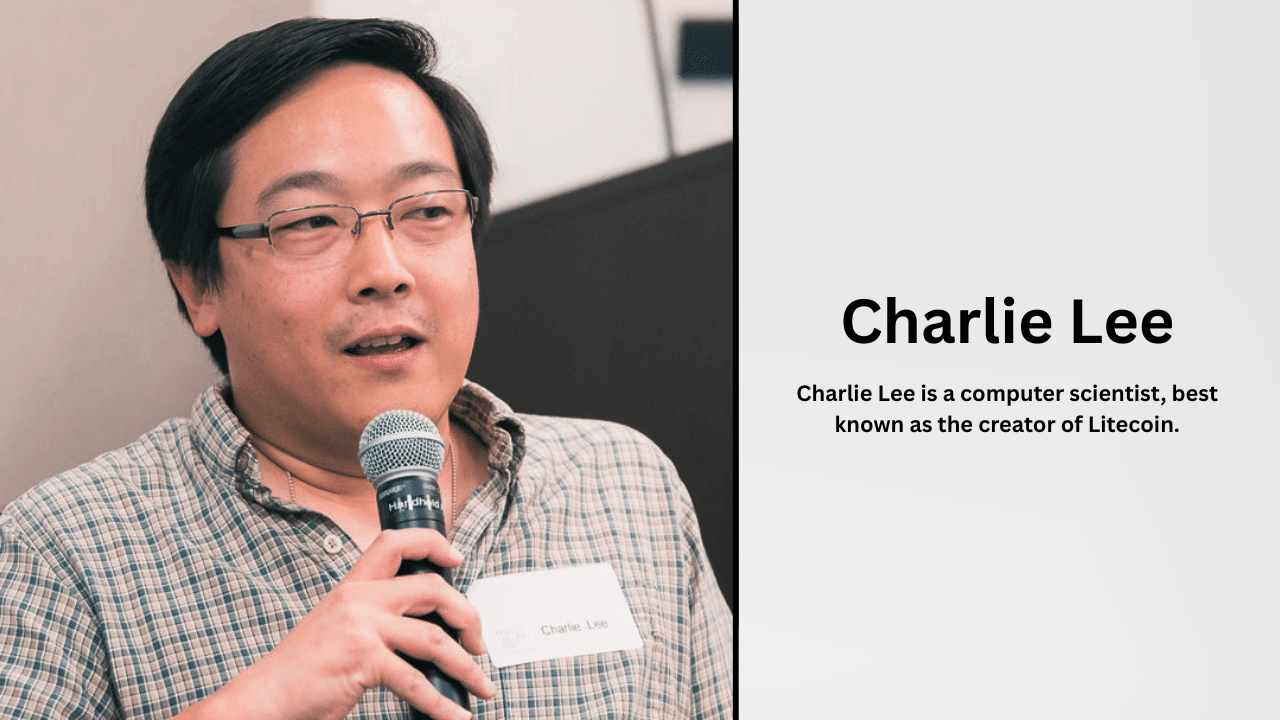

For nearly 15 years, Litecoin just kept doing its thing, no noise, no drama. It launched back in 2011, built by Charlie Lee, a former Google engineer, and from the start, it positioned itself as Bitcoin’s faster, lighter sibling.

With 2.5-minute block times and fees that barely touched a penny, it became the go-to option for quick, everyday transactions, whether it was sending crypto to a friend, paying a merchant via BitPay, or even booking travel through Travala.

But while the rest of crypto was evolving, Ethereum launched smart contracts, DeFi was blowing up, NFTs were going mainstream, and Litecoin stuck to payments. It was solid for moving money, no doubt, but that’s all it could do. And in a world shifting toward programmable and interconnected systems, it started to feel like it was being left behind.

Then, in May 2025, things changed. At the Litecoin Summit in Las Vegas, the Litecoin Foundation introduced LitVM. This wasn’t a gimmick or side experiment; it was a proper shift in direction.

LitVM brought an EVM-compatible, zero-knowledge Layer-2 to Litecoin, unlocking smart contracts and Web3 functionality. For the first time, Litecoin wasn’t just digital money; it was stepping into the world of programmable crypto.

A Team United by Vision

LitVM doesn’t exist in a vacuum. It bears the imprint of seasoned experts and dedicated institutions. At the center is Lunar Digital Assets, a Web3 development firm led by Roc Zacharias, whose strategic ambition was to build bridges, not clones, between blockchain ecosystems.

Collaborating closely with Lunar were Polygon Labs, contributors to the rollup landscape, and notably Inscriptions Labs, whose early work on Bitcoin-layer ZK innovation set the technical foundation.

Key voices behind the project include Edan Yago, co-founder of BitcoinOS, the rollup engine enabling trustless bridging with major UTXO chains; and David Schwartz, a veteran of Litecoin’s community, stewarding the transparent treasury and governance model for LitVM.

What made it hit even harder was the backing it got from the top. Charlie Lee also showed strong support for the project at the summit, highlighting how important LitVM could be for Litecoin’s future, potentially its biggest leap since SegWit.

And the Litecoin Foundation was fully on board too, making sure LitVM sticks to what Litecoin’s always stood for keeping it secure, simple, and truly decentralized.

Why Litecoin Could No Longer Stand Still

To understand what LitVM means, you must first grasp what it’s replacing. Litecoin’s core was never flawed; it was just limited. It could execute lightning-fast transfers, but couldn’t run Ethereum-style smart contracts, power decentralized exchanges, or tokenize assets natively. That left its users on the sidelines of a rapidly innovating industry.

Ethereum and its L2s (“rollups”) were sprinting ahead, spawning entire industries in Art (NFTs), Finance (DeFi), Gaming, Identity systems, and more. Litecoin users watched as entire economies formed around new on-chain capabilities. Yet they had little ability to participate, because Litecoin lacked the infrastructure.

That begins to change with LitVM. Its mission is twofold: preserve Litecoin’s core strengths while enabling everything it lacks. Fast, low-cost settlement remains the baseline.

On top sits a trustless layer where developers can deploy contracts, and users can trade, mint NFTs, stake, lend, govern, and even tokenize real-world assets. The payoff? Litecoin finally enters the mainstream of Web3 innovation.

The LitVM Architecture: Building the Next-Gen Litecoin

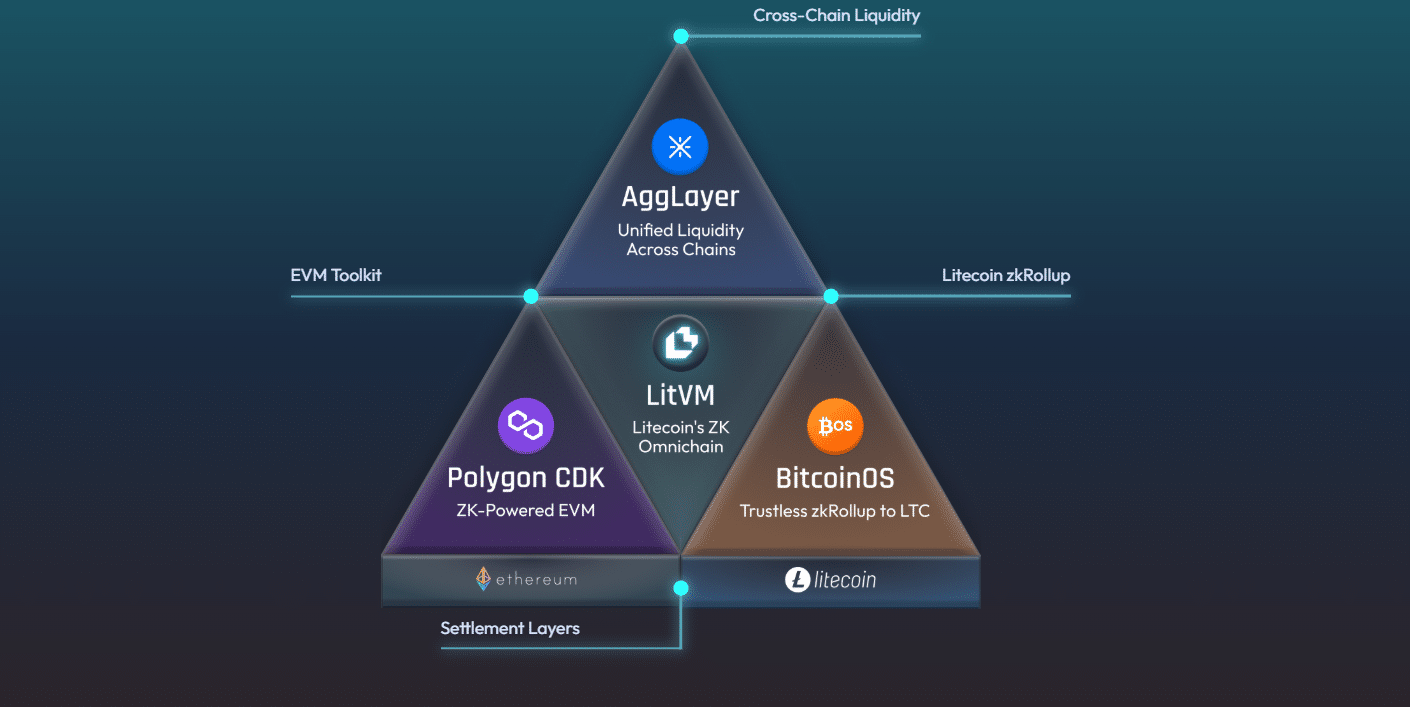

LitVM’s backbone is a triad of sophisticated technologies integrated seamlessly:

BitcoinOS (aka BOS)

Originating in the Bitcoin space, BOS made its mark on testnet and mainnet Bitcoin rollups in 2024. In the context of Litecoin, it acts as the first trust layer. BOS aggregates off-chain transactions and publishes succinct zero-knowledge proofs on Litecoin’s L1.

That enables smart contract settlement and asset bridging, without losing Litecoin’s core decentralization.

Polygon CDK + Erigon

This layer gives LitVM its EVM stature. Thanks to Polygon’s Chain Development Kit and their optimized Erigon node implementation, LitVM supports Solidity, Vyper, Hardhat, Truffle, MetaMask, and essentially every Ethereum dev tool out there.

That means developers can write, test, and deploy contracts almost identically to how they would on Ethereum, but on a cheaper, faster network that charges fees in LTC.

AggLayer

While BOS secures settlement and CDK runs contracts, AggLayer drives interoperability. Built by Polygon Labs, AggLayer connects multiple chains, including Litecoin, Ethereum, Polygon, and more, into a unified liquidity system. It supports cross-chain swaps, atomic transactions, and cross-system messaging.

A developer can build a DeFi exchange that sources liquidity in Ethereum, settles trades on LitVM (in LTC), and moves assets seamlessly as needed, all trustlessly and atomically.

Together, this stack makes LitVM not a fork, but a full reimagination of Litecoin as both a programmable chain and an interoperable Web3 node.

Popular Use Cases LitVM Unlocks

Here’s how LitVM expands possibilities:

- DeFi Platforms: Launch AMMs, DEXs, lending protocols, and yield farms that use LTC and bridged assets like BTC and stablecoins. And thanks to AggLayer, liquidity comes from chains like Ethereum, maximizing trading access and fluidity.

- NFT and Cultural Tokens: Litecoin fans can mint “Lordinals,” Charms, Runes and others as NFTs, then trade them on LitVM marketplaces with royalty support, metadata anchoring (tools like IPFS), and cross-chain compatibility.

- Gaming Economies & Metaverse: Imagine games with real LTC-based economies, cross-chain mechanics, and collectibles deployed on an EVM-like environment, but powered by PoW security. That’s a first—and it becomes possible with LitVM.

- Payment Infrastructure: With system-level privacy (courtesy of Litecoin’s MWEB and ZK-proof systems), LitVM makes programmable micropayments and subscription systems practical and cheap.

- Real-World Asset Tokenization: Through smart contracts, real estate, commodities, or bonds can be issued as tokens. BOS ensures settlement on Litecoin L1, giving such assets PoW-level trust.

- DAOs and On-Chain Governance: Community treasuries, voting mechanisms, and decision systems become possible, governed transparently via token-based voting and executed on-chain.

- Privacy Tools: Beyond financial tools, developers can build zk-backed identity systems, decentralized mixers, and encrypted data tools—something Litecoin never supported before.

These aren’t ‘what-if’ theories, they’re actively developing. Developers are already building smart contracts and bridging tokens on LitVM’s live testnet.

Governance, Grants, and Community Power

LitVM’s team recognized the importance of sustainability. That’s why they’ve established a robust funding and governance structure. A multi-signature treasury, jointly controlled by community leaders, builders, and Litecoin Foundation members, governs all grants and expenditures.

So far, LitVM has:

- Allocated developer grants to early builders.

- Sponsored hackathons to seed ecosystem growth.

- Set aside liquidity incentives to drive adoption.

All program information and decisions are public by design. That transparency has won the trust of core Litecoin users and attracted growing interest from Ethereum-native developers.

Scaling for the Future

LitVM launched its first developer testnet in late 2024 and early 2025. Since then, the engineering team has prioritized stability and security:

- Security audits are underway for BOS, cross-chain bridges, and protocol logic.

- Wallet adapters are being finalized so MetaMask and hardware wallets can support LTC gas.

- Bridge launches between LTC, BTC, and Ethereum will roll out in phases.

- The full mainnet rollout is on track for late 2025.

Once live, LitVM aims to swiftly grow in tandem with Ethereum rollup ecosystems, targeting new DeFi protocols, NFT platforms, gaming studios, and institutional RWA pioneers building on top of it.

Strengths in Context

LitVM brings significant advantages:

- Security First: Settlement on Litecoin PoW is coupled with ZK-layer validation.

- Developer-first approach: EVM compatibility ensures low-friction onboarding.

- Cross-chain reach: AggLayer lets apps leverage multiple blockchains’ liquidity.

- Privacy and programmability: MWEB combined with zk gives optional confidentiality.

Still, it must confront typical Layer‑2 challenges:

- Technical complexity: Maintaining cross-chain systems isn’t trivial.

- Bootstrapping community engagement: building liquidity and user traffic takes time.

- Audit and resilience: ensuring the system withstands attacks and edge cases.

- Regulatory scrutiny: especially where anonymity meets Defi and tokenized assets.

The team has actively addressed these issues, hosting bug bounties, community audits, and developer grants to surface and resolve edge-case vulnerabilities early.

The Bigger Picture for Litecoin

No longer just “fast money,” Litecoin now steps into a new role: a programmable, interconnected chain fully aligned with modern crypto’s future. This move has strategic implications:

- For developers, it means launching smart contracts on a trusted PoW chain that isn’t fragmented like Ethereum’s many L2s, one chain to rule them all.

- For users, existing LTC holders gain on-chain utility without leaving the ecosystem.

- For institutions, it means deploying assets or compliance tools on a socially backed, permissionless chain, capable of bridging with other ecosystems.

- For governance, it’s a self-funded, community-controlled model that encourages long-term sustainability and decentralization.

LitVM is more than an add-on; it’s Litecoin’s second act.

What Comes Next?

The coming months will be critical.

- Mainnet launch by year’s end is the next milestone.

- Wider wallet support and mainstream DeFi portals will drive adoption.

- Regulation-savvy compliance modules may be included to ensure institutional appeal.

- Extensions of the AggLayer model, bringing more chains and features to the LitVM system.

- DAO formation is expected, empowering token-based governance and voting functionality.

Let’s return to where this story began. Litecoin is a silent workhorse, perfect for peer-to-peer payments. Today, that same chain is undergoing a dramatic upgrade via LitVM. It’s joining the realm of programmable blockchains with native smart contracts, cross-chain liquidity, developer-first tools, and a transparent community structure.

It’s still quiet; there’s no flashy token airdrop or viral hype campaign. But in the steady hands of its developers, engineers, and community stewards, Litecoin is recharging itself for the next cryptoeconomic era.

The transformation is comprehensive: Litecoin no longer just moves value, it creates, executes, and interconnects. In staking that future on ZK cryptography, EVM toolchains, and an omnichain model, LitVM embraces the broader crypto vision without compromising on what made Litecoin essential.

Also Read: Why Nibiru Chain is the Hidden Gem in the Cosmos Ecosystem